Personalized service is a pillar for building our dayto-day relationship with the customer. To respond to the unfavorable economic environment that affected consumer spending, we offered a diverse range of promotions to stimulate customer shopping.

The Liverpool credit card has traditionally been the most frequent payment channel for our customers in our stores. In 2013, the credit portfolio grew by 17.7%; at the same time, we were able to maintain low levels of non performing loans.

We continued expanding our service and insurance offer by presenting home, health, life and general welfare coverage. Income on commissions brought about by said activity grew by 17.1% versus that of 2012.

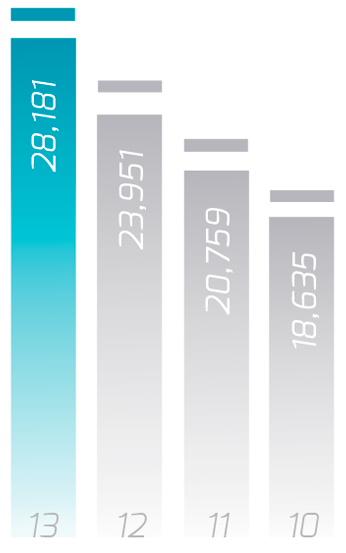

Credit loan book

Our customer centric focus favors the alignment of our commercial offer by providing particularized merchandise in the right stores at the right price at the right time. Additionally, we optimized the selling space in our different departments, by tailoring the merchandise catalogue and targeting the preferences and needs of the customer according to each location and channel, while we favor profitability